Refinancing immediately following forbearance

How much time you are necessary to hold off is dependent on brand new facts of your financial hardship and you can whether you left with people scheduled money included in the forbearance package.

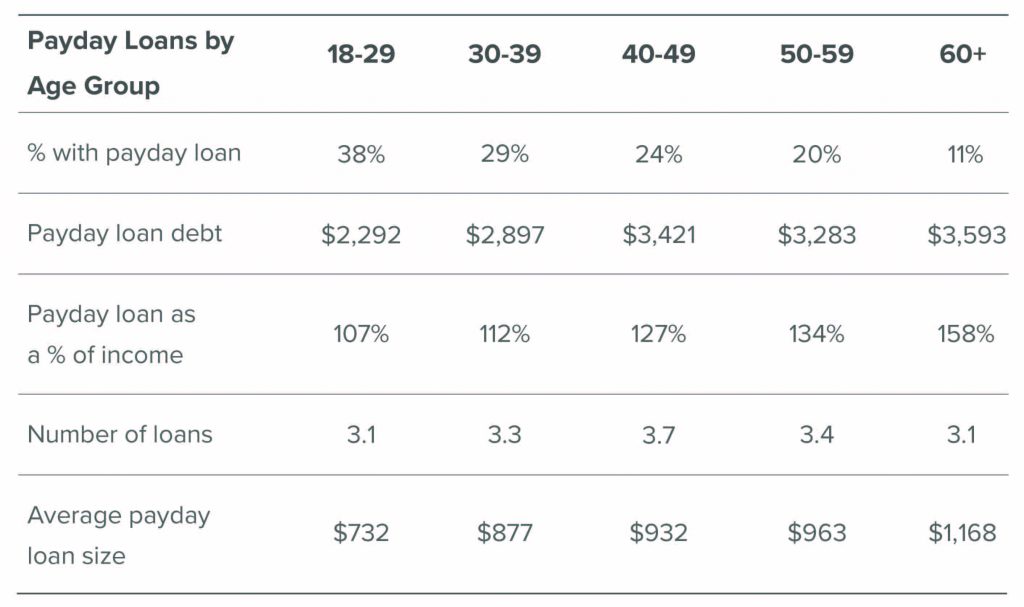

For individuals who entered forbearance due to COVID-19, you usually need not wait anyway, as long as you have made their current three to six repayments timely. The fresh new table less than suggests the main points:

However, in the event the dilemmas have been not related so you can COVID, you might be stuck waiting around for to one year just before you can re-finance.

Refinancing shortly after mortgage loan modification

If you have become from the loan modification techniques along with your financial, you’ll be able to routinely have to attend twelve in order to 2 yrs after the mortgage loan modification so you’re able to qualify for a good re-finance. Yet not, in the event your loan mod are after you exited good COVID-19 forbearance system, it’s not necessary to wait, as long as you produced the past half dozen so you’re able to 12 costs of your https://cashadvancecompass.com/payday-loans-fl/ own loan modification on time.

Choices in order to refinancing having later payments

If you’re unable to refinance your own financial, you may have some selection to fall straight back on. Your own right course of action is based on your own home loan style of, exactly how past-owed youre along with your lender’s selection. While some of those possibilities allows you to stay-in their domestic, other people dont.

Consult your lender instantly to go over the options and next strategies. A great HUD-accepted construction therapist can also bring then pointers.

Fees plan

With a fees plan, your own bank will give you a structured arrangement to get to know their late otherwise unpaid mortgage repayments. This consists of using an element of the early in the day-owed count along with your monthly obligations through to the loan is actually most recent. Your lender ount up until the stop of one’s mortgage term.

Typing a cost package makes you stay in our home and you will promote the loan newest if you cannot re-finance the newest unpaid home loan.

Financial forbearance

While you are experience pecuniary hardship – loss of a career, infection, pure crisis and other incidents – it’s also possible to qualify for home loan forbearance. With a home loan forbearance, the lender commonly

Keep in mind that forbearance does not get rid of the paused or quicker costs. Notice on the financing continues to accrue, plus financial will give options for recuperating the reduced or paused number.

Home loan modification

A home loan amendment reduces your payment by changing the words of one’s loan. Such as for example, the financial could possibly get customize your own home loan by the stretching the mortgage identity, reducing the rate of interest or decreasing the dominant balance.

You can confuse loan mod that have refinancing, nevertheless the a couple aren’t the same. That have that loan modification, you can easily continue to have the same mortgage and you will financial but with changed words. Additionally, you may not pay costs or closing costs to modify your mortgage. Simultaneously, for those who re-finance, you should have yet another mortgage you to definitely pays off current home loan harmony – although additionally have to pay refinance closing costs.

Brief income

Should your financial was underwater – after you are obligated to pay regarding your loan compared to home is value – you might want to believe a preliminary deals. A primary revenue enables you to offer your home for cheap than its value, plus lender accepts the fresh continues of your own marketing because the payment of financing, tend to instead of your being required to assembled the complete mortgage matter. While you are a short marketing commonly negatively feeling their borrowing, the results is less unsafe than you’d see having a foreclosures in your number, while could also possess some of your personal debt forgiven.