Enabling users as if you reach the economic desires is perhaps all we manage, this is the reason we’re equipping your with the help of our expert understanding, information, and you may pointers to obtain indeed there.

- Financial Things

- Real estate Solutions

- Life & Family

- Refinance Solutions

- APM Insider

six Most often Requested Questions about Va Finance

For folks who or someone close has offered your nation and are actually looking to buy a house, you can even question for people who be eligible for a good Virtual assistant loan.

Va mortgage loans provide a great deal of experts, for example zero down payment requirements, no personal mortgage insurance rates (PMI) payment, and versatile underwriting recommendations.

Listed here are more aren’t requested questions about Va financing. But basic let’s establish which qualifies having good Virtual assistant mortgage. You might receive good Va mortgage while you are a dynamic-obligation provider representative, seasoned, otherwise thriving lover away from an experienced. Including pros having services-connected handicaps.

People that qualify are certain to get a certification regarding Qualification (COE) just like the facts that they’re qualified to receive a good Virtual assistant mortgage. If you do not possess a copy of your COE, your loan Advisor will help you.

step 1. Are there Settlement navigate to website costs On the a good Va Financing?

As with of several loan software, Va loans would include some of the basic settlement costs and you may fees. These are typically charge you would select of all fund, in addition to toward appraisal, title look, label insurance policies, recording payment, or other bank charge.

One to payment that is particular to Virtual assistant loans ‘s the Virtual assistant capital fee. You pay that one-day payment to the brand new Virtual assistant to save the mortgage system supposed. The dimensions of the brand new Virtual assistant money percentage relies on several items.

Getting first-day have fun with, the fresh new resource percentage is 2.125% of your own total loan amount. The resource fee grows to 3.3% to possess individuals who have used this new Virtual assistant mortgage program, nevertheless is going to be reduced because of the getting money down. Veterans that are more than ten% disabled tends to be excused from this payment.

There are lots of methods prevent make payment on Va financial support percentage with your own money. You could negotiate to get the merchant pay which fee, you can also move new capital percentage into the financial and finance it along the lifetime of the loan.

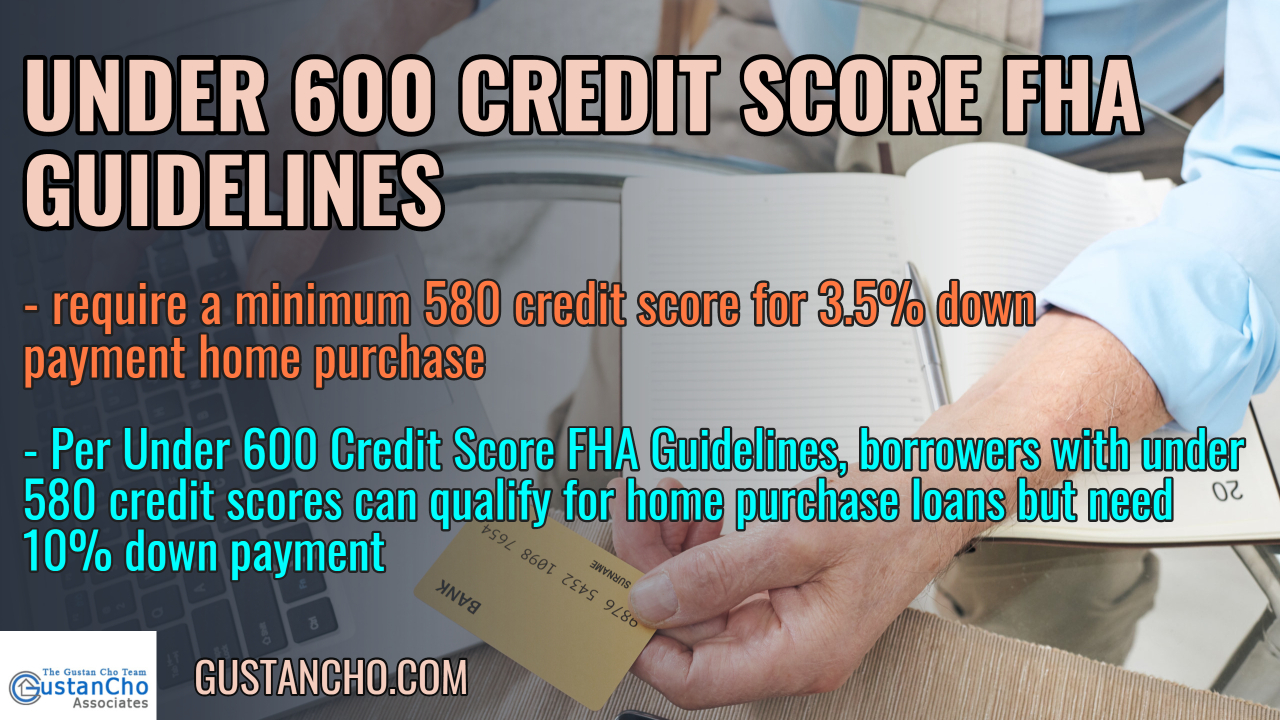

dos. Exactly what Credit score Manage Now i need for a Va Mortgage?

Credit rating conditions are among the greatest concerns for some homeowners, but they are you ready for the majority of great? There’s no credit score need for Virtual assistant financing.

Because exciting since this is, just remember that , whilst Va mortgage program doesn’t place at least credit rating, private loan providers do. From the APM, the minimal FICO get requirement is 580 having Va finance, that provides applicants a lot more leniency. But not, it is critical to keep in mind that not all the loan providers have the same demands.

It is in addition crucial to keep in mind that the better your own score, the better your own interest and you will mortgage terms and conditions would-be. To learn where you’re, you can obtain their free credit report once a year from all the about three credit reporting agencies-or you can affect an enthusiastic APM Loan Mentor from the clicking here to arrange a totally free pre-qualification.

If you learn that you’ll require help enhancing your credit score, the knowledgeable APM Loan Advisers are always here to simply help. We have been prepared to sit-down to you to go over debt state and how you could change your FICO score before you apply having an effective Virtual assistant loan.

3. How frequently Do i need to Use My Va Financial Work with?

As often as you wish. There’s no restriction about how exactly of several Virtual assistant funds you might need in yourself.