Household Guarantee Loans against HELOC: Which one Works best for Both you and As to why

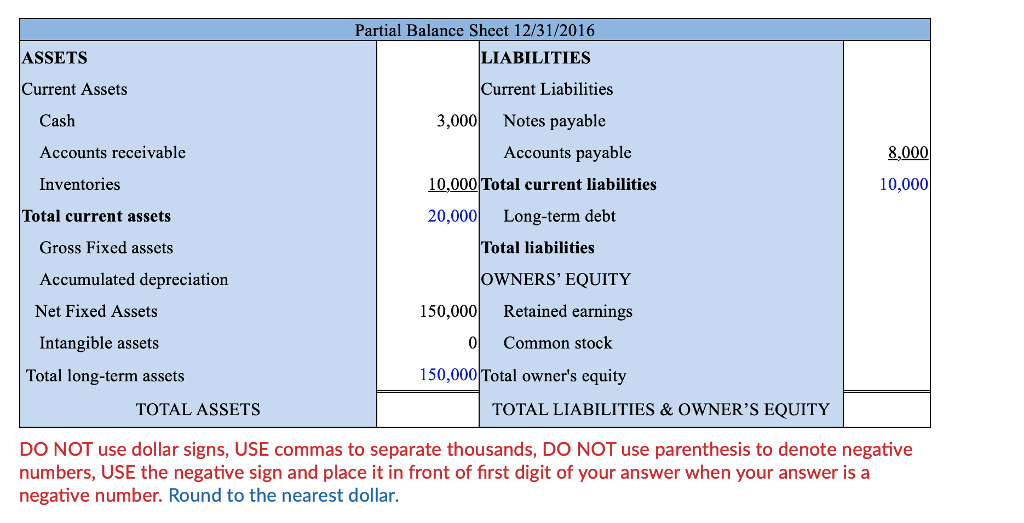

If you find yourself a resident trying supply your home security, you happen to be considering property guarantee loan otherwise a house equity line of credit (HELOC). Each other choice allow you to utilize your residence security, the difference between industry value of your property together with a great balance on your financial. Whenever you are these particular finance show specific parallels, they also have distinctive line of differences which make all of them suitable for various other financial things.

A house collateral financing will bring a lump sum payment of cash with a fixed rate of interest and you may payment, it is therefore perfect for higher, one-go out expenditures. In addition, an effective HELOC services similar to credit cards, taking a great rotating personal line of credit with changeable interest levels and interest-only costs when you look at the draw several months, making it most readily useful suited for lingering expenditures otherwise programs.

Your credit score, the degree of guarantee of your home, together with function of the loan are common secrets so you can envision when determining between a house equity financing or HELOC. At exactly the same time, settlement costs and other charges will get perception your decision.

In this blog post, our very own experts in the iTHINK Economic will assist you to mention the key have, masters, and you may disadvantages out-of domestic collateral finance and you may HELOCs so you’re able to determine which solution best suits your unique financial situation.

Everything about Household Equity Fund

A property security mortgage, labeled as a moment financial, allows you to acquire a lump sum of cash against the guarantee of your house. The borrowed funds amount is based on industry value of your own family, your credit score, in addition to quantity of equity you may have built up.

Secret Attributes of Domestic Guarantee Funds Are:

Lump-sum disbursement: You receive the entire loan amount initial, so it’s ideal for highest, one-date expenditures such as for example household renovations, debt consolidation, otherwise big requests.

Repaired fees terminology: House guarantee fund normally have repaired installment terms anywhere between 5 so you can 30 years, enabling you to choose a term that suits your budget.

Benefits of Family Guarantee Loans:

Repaired rates of interest: Unlike HELOCs, household equity loans offer the stability from a fixed rate of interest, protecting you against prospective speed develops.

Suitable for highest, one-day costs: A house collateral financing are the best selection for individuals who have to acquire a tremendous amount to have a specific mission.

Drawbacks from Home Security Fund:

Discover reduced flexibility versus HELOCs: After you have the lump sum, you simply cannot borrow more funds as opposed to obtaining another type of loan.

Possibility more-borrowing: Acquiring a huge amount of cash simultaneously can get tempt your so you can obtain over you would like, leading to higher monthly obligations and you will increased debt.

Risk of foreclosures: As with any loan secure by your domestic, failing woefully to build money to your a house equity mortgage you certainly will influence from inside the property foreclosure.

In terms of a home collateral mortgage, comparing rates, settlement costs, and you will fees terminology out-of numerous loan providers https://paydayloansconnecticut.com/sherwood-manor/ is important to discover the cheapest price to your requirements.

What things to Learn about House Collateral Personal lines of credit (HELOCs)

A house collateral line of credit (HELOC) was a rotating personal line of credit enabling one borrow secured on the fresh new guarantee of your home. Like a charge card, you could potentially mark funds from the HELOC as required, around your acknowledged borrowing limit.

Secret Features of HELOCs Were:

Varying rates of interest: HELOCs typically have variable interest rates one to vary predicated on industry criteria, so that your monthly obligations get change over date.

Revolving credit line: You can borrow funds, pay all of them, and you will acquire again as needed within the mark months, which usually continues 5 to help you 10 years.