Signature loans try a convenient way to get a lot more money for emergencies. If you are searching to possess a personal bank loan, after that undergo this task by action way to get a personal loan now!

Occasionally from unforeseen expenses for example hefty scientific expense, immediate house fixes, an unexpected jobs loss if not a repayment escalation towards relationships you’re so awaiting, signature loans is also bail you out of a gluey disease. Very, just how do prospective borrowers indeed go about taking a consumer loan to start with? Listed here is a step-by-action guide on exactly how to rating a consumer loan at a fast rate and you can without having any hassle.

Favor a reputed financial

Because there is a huge arranged and you can unorganized markets from lenders, possible borrowers should do far better like a reputed financial. Not just carry out so it let rating a person a knowledgeable deal in terms of interest levels and in addition improve entire process seamless, hassle-100 % free and you can short.

Evaluate eligibility

Before you apply to own an unsecured loan, borrowers need to learn exactly how much personal loan he could be eligible to have. The brand new eligibility tend to generally confidence specific specific requirements including their month-to-month income or business earnings, its already productive loans and you may EMIs and also the combined the count into the almost all their handmade cards. Essentially, it will count on how creditworthy a person is since a beneficial debtor.

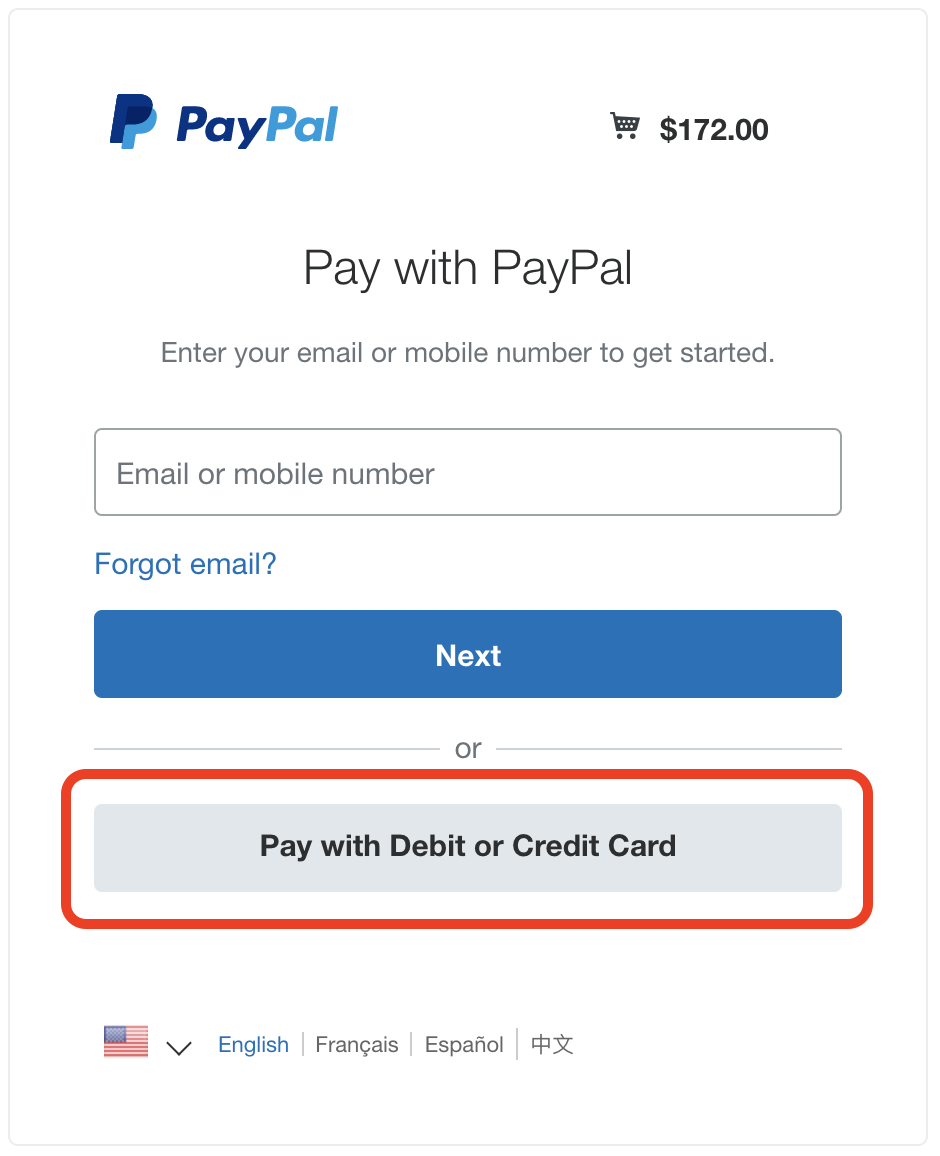

Pertain on the internet

Most regulated lenders allow individuals to apply for a personal loan on the particular other sites by completing a straightforward on line setting. All that individuals trying accept financing have to bring was its basic info. They might be private information eg term, many years, address, phone number, Pan and you can Aadhaar card numbers, a position or company facts, and you may details about its income otherwise team income. Most lenders have the present users, especially those with a good credit rating, that have pre-acknowledged funds they can take advantage of in minutes.

ount and you may loan stage

Remaining its mortgage eligibility in mind, individuals must ount of money they should use and you can based on how long. Signature loans usually hold a top interest rate, while the rates as well as varies according to period. Thus, you will need to make an effort to secure the number and you may stage once the reasonable to, even though he or she is entitled to acquire more. Borrowers may also choose cost selection, month-to-month otherwise, when the the lender lets them to, a versatile solution.

Paperwork

Extremely good loan providers usually succeed consumers to try to get a personal loan from the comfort of its household, simply by signing on to its other sites. However some loan providers deploy its manager to gather all of the needed records in the borrower individually, a number of lenders also allow borrower just to publish brand new data on the other sites. These types of documents can include one or more of the following-a copy of one’s Dish otherwise Aadhaar card, salary glides or providers money proof of going back half a dozen so you’re able to 12 months, bank account comments of your own income or company money account fully for the previous couple of weeks, a duplicate out-of company ID proof, if employed, and stuff like that. This new papers may differ regarding financial to help you bank. A borrowers is generally expected to submit so much more data files. Since a personal loan try an uncollateralized loan, zero guarantee records are needed.

Mortgage disbursal

Just after a lender approves the data files the borrowed funds number might possibly be paid for the borrower’s savings account for the faster twenty four hours. Therefore, this is one way basic its discover an effective unsecured loan. The next time you are short to the money, a personal bank loan is the best friend.

Paying off the loan

Generally speaking, repayment plans want partial monthly costs regarding one another prominent and you will attention quantity in varying proportions. A e signature installment loans borrower is going to be sount first, because that may reduce the total focus outgo, because financial doesn’t charge any further interest once the principal are paid off fully. Additionally, consumers can decide to invest only the attract bit thru equated monthly payments (EMIs) very first and then the dominating number at the conclusion of brand new tenor of the loan. This one facilitate individuals who cannot shell out increased EMI comprising each other interest and you can principal for some reason.

Achievement

Getting a personal bank loan is a simple and you will problems-totally free process, about as long as you have a very good credit score and you will a healthy and balanced credit history. Also, good bank also offer you a nice-looking speed out-of notice and can personalize their installment package to suit finances disperse position. For individuals who approach an established and you can really-addressed lender like IIFL Fund, you can buy your loan paid right away, straight from your residence. Actually, IIFL Financing checks for a beneficial borrower’s eligibility private financing upwards in order to Rs 5 lakh in this a few moments. The application is additionally simple and totally online. It even pre-fulfills the web based mode owing to Aadhaar research and you will enables you to upload your write-ups so you’re able to approve the loan within seconds. So, next time you desire an image financing, you understand in which to go.