Even an it seems that brief difference in rates of interest might have an excellent extreme effect on simply how much you wind up investing as appeal throughout the mortgage label. The details you to uses arises from myFICO, highlighting home loan costs from the credit score and you may proving exactly how the month-to-month money are very different should you get a beneficial $200,000 31-year repaired-price financial. The wide variety imply national averages. The mortgage prices work well since .

The difference in the monthly premiums involving the finest and you will base sections stands on $218. Over the course of thirty years, this will amount to more $78,000.

Additional factors That affect Financial Costs

When you find yourself the creditworthiness takes on an important role in the interest rate that relates to your own financial, loan providers examine other variables too. Along with, financial cost continue modifying according to research by the Fed’s financial plan, monetary increases, and you can inflation.

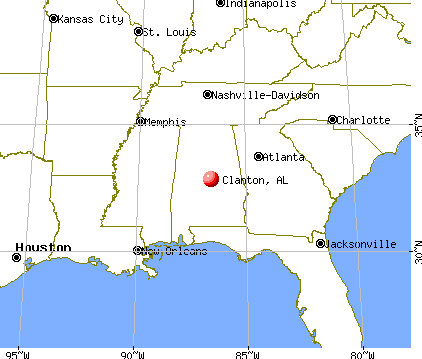

- Location of the home.A research released of the Federal Set-aside Financial out of Dallas indicates you to definitely area plays a crucial role for the home loan prices, hence usually cover anything from you to definitely location to a higher. It, by the way, is even the fact having rural portion.

- Amount borrowed and cost of the house. For many who want a tremendously short otherwise large amount borrowed, you ount you really need to borrow is basically the essential difference between the brand new residence’s price and down payment amount.

- Deposit. Generally speaking, and work out an enormous downpayment has a lower interest. Simply because their lender commonly see you because a minimal-risk borrower, given the equity you own of your home. If you are comfy making a downpayment off 20% or higher, doing so my work better for you on much time-title offers attitude.

- Mortgage name. Quicker loan terms will have all the way down interest levels when versus offered terminology. not, needed you generate big monthly premiums.

- Debtto-income (DTI) proportion. The DTI proportion means exactly how much of money you earn each month goes toward your debt money. Financial company wanted it number become 43% otherwise down. Loan providers have a look at reduced DTI percentages having favor, which may following translate into a lower rate of interest.

- The financial institution you choose. Rates of interest elizabeth version of mortgage with regards to the lender you come across . Mortgage business charges some other rates of interest based on facts eg above will set you back, feel, character, and you will income. https://paydayloanalabama.com/reeltown/ Bear in mind that the financial institution that provide a minimal rates is not the finest because you should also account having customer service and you may self-reliance in terms.

Simple tips to Replace your Credit score?

When your credit score is not up to the mark, think improving they before you apply to have a mortgage. Performing this helps start a great deal more avenues and you may together with benefit from a lowered rate of interest. Adopting the several simple actions can set you on the right highway.

Remark Your own Credit reports

Start with providing a duplicate of your credit file regarding the best three credit reporting agencies Experian, Equifax, and you will TransUnion. Undergo each very carefully to decide why your credit score was lower. There are instances when credit file carry incorrect information, so be looking for these. If you learn one error, contact the credit bureau and ask for it to make the required modification.

Spend Your own Debts punctually

One of the different factors which affect your credit rating , payment record takes the top room, bookkeeping to have 35%. Given the impact it foundation has, it is important to pay all the debts on time. You’ll be able to monitor their debts through some kind from processing program or function notification. Automatically purchasing your expenses from the connecting these to your money is ideal. You may also think purchasing their debts using credit cards to make perks and you will replace your credit rating, however, tread that it street on condition that you’re sure you will be able to pay off the mastercard equilibrium in full every month.