The three applications given below offer financial support to lower-earnings house and make improvements on the structure out-of home they very own and you may consume:

OCHRA Houses Treatment Loan Program

The new Olmsted State Property & Redevelopment Power (OCHRA) provides commercially circulated brand new Housing Rehab Program. This option deliver financial help to help you being qualified low and you can average-income people to help with keeping, fixing, and you can improving the cover, livability, and effort overall performance of the home.

That have finance provided with the brand new OCHRA, this new Housing Rehabilitation system offers 2 kinds of guidance offered with the a first-started, first-offered foundation so you’re able to being qualified home:

- Rehabilitation Mortgage: Treatment Loan finance are often used to best risky standards and code violations, eliminate security threats, fix or exchange biggest possibilities, right indoor otherwise exterior deficiencies, opportunity advancements, modifications for persons having disabilities and you will remove lead-oriented color problems. The minimum amount borrowed is actually $5,000. The maximum amount offered was $25,000. Money have mortgage loan away from 2%, regardless of if zero principle or attract payments were created until the domestic is available.

- Entry to Mortgage: Entry to Mortgage finance can be used for the brand new removal of structural traps additionally the laying out unique devices and you can products having physically handicapped otherwise earlier homeowners. Allowable installations and you will fixes are however they are not limited towards the structure from ramps, adjustment from doors, lowering of basins, commodes, shelves, having special faucets, doorknobs, switches, and you will laying out handrails. There is absolutely no lowest count. Maximum loan amount readily available is actually $5,000. Accessibility loans is forgiven more a 7-seasons months in accordance with a zero % interest.

As qualified to receive advice, your house has to be based in Olmsted Condition (please note, residential property based in Stewartville, are not eligible) therefore must have possessed your residence for at least half a dozen (6) weeks ahead of choosing advice. You need to be most recent in your home loan along with the new payment of your own a residential property/assets taxes. On the other hand, you can’t exceed the family earnings constraints here:

MHFA Rehab Program

The fresh new Minnesota Construction Funds Agency’s (MHFA) Treatment Loan program support reasonable so you’re able to reasonable-earnings people inside money renovations you to definitely yourself change the safeguards, habitability, energy savings, and you can use of of its belongings.

Qualified applicants must take your house to-be rehabilitated. Applicants’ property cannot exceed $25,000. Rehabilitation Mortgage Program earnings restrictions are derived from federal median nearest and dearest earnings rates and you may calculated at 29% of your Minneapolis/St. Paul town average money. The money maximum to have 2018 are $28,three hundred to have a household away from five.

Maximum loan amount are $27,000 having an excellent 15-season label, and 10-decades getting mobile/manufactured home taxed while the private possessions. Loan percentage try forgiven in case the residence is maybe not marketed or transported, and you can stays filled, for the financing title.

Most developments to the livability, access to, or energy efficiency out of a house meet the requirements. Electricity cables, a unique roof, plumbing system, and you can septic fixes are just some of the options.

This method assists reduced to average-money people surviving in the target urban area with financing renovations you to definitely physically affect the safety, habitability, energy savings, and you will access to of their home.

Brand new finance are attract-100 % free. The most amount borrowed try $25,000 financing maximum with dos% desire. The loan are reduced in the event the loans Georgetown CO debtor offers, transmits term, or no stretched lives in the house.

Most improvements for the livability, entry to, otherwise energy savings off a home qualify. Electrical wires, a unique roof, and you can plumbing work are just some of the options.

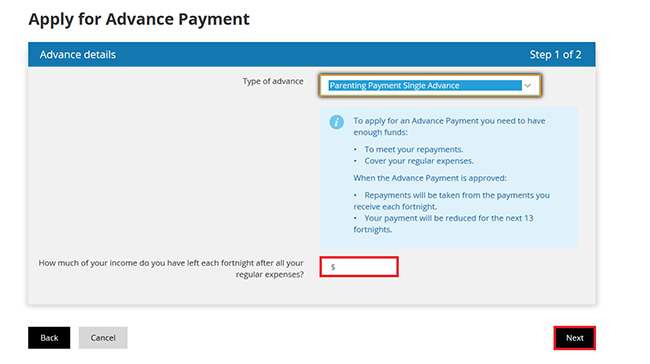

People entitled to this option need to take our home to get rehabilitated. Applicants’ possessions should not go beyond $twenty-five,000. The newest qualified Adjusted Gross Yearly Household Earnings Maximum for a treatment Loan lies in the size of the family. Your family money limits are ready because of the U.S. Agencies away from Construction & Urban Innovation (HUD) and are usually modified annually. Yearly income cannot go beyond the lower-money constraints set by the HUD’s Casing Choice Discount Program. Money constraints decided by number of persons inside the per family.

The Rochester Town Council possess assigned everything $250,000 of the Neighborhood Invention Block Offer funds to that system a-year. This option usually enhances ten-12 residential property per year. There’s usually a located checklist for it program. Money are often designated on slide as they are offered the fresh new following spring. Typically the treatment performs starts in the summertime.

Income limits getting 2020 HRA Rehab Financing Program

***Note: Revise tables within the CDBG agreements and Part 3 putting in a bid versions sent 09-03-20 to help you Luke Tessum, Urban area Family Rehabilitation Program