You are going to qualify for a home loan if you possibly could generate steady income, whether or not operating or care about-working. Due to the fact a self-employed borrower, proving which you have a professional supply of fund is probably the most vital preparing.

Bank statements and you will tax returns several popular ways to prove your secure monetary channels. It is necessary to ensure that you could potentially establish your own earnings which have good documents.

Create your income history offered

Extremely financial companies would wish to visit your income records to have about the past seasons. For this pointers, loan providers will opinion your taxation get back.

Replace your way of ensure you enjoys a tax return one suggests a robust net gain, particularly if you come in new habit of using much from create-offs.

Bank statements is actually a different way to establish the economic resource. Loan providers usually inquire about as much as 24 months’ value of bank statements to calculate the mediocre monthly income. This will be based on dumps made into your bank account.

Make a large down payment

Lenders basically see you just like the less of a risk for individuals who build a giant deposit given that in that way, there’ll be reduced personal debt to repay. The month-to-month mortgage repayments might possibly be lower, and you can have less currency lent for people who default. Which have a down payment more than 20% might also save you away from having to pay personal mortgage insurance coverage.

Not only will a massive down-payment succeed more comfortable for you to definitely qualify for a mortgage, however it may make you the means to access most useful conditions such as for instance down interest rates.

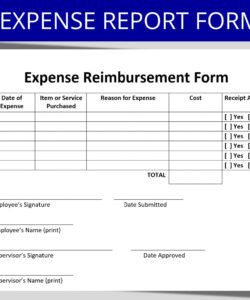

Prepare all of your financial files

The loan top-notch you are dealing with allow you to know which economic documents you really need to render. Even though it may vary, bank comments and you will taxation statements was most requested. Check if you may have those https://paydayloansconnecticut.com/stamford/ who work in useful. Otherwise, have them as quickly as possible.

Since the notice-operating homeowners tend to have more complicated sources of earnings, they need to dig better. Linking your accountant with your lender is a sure way of performing it otherwise providing a great deal more proof of earnings.

Make an effort to cut

This isn’t a requirement however, protecting larger makes it possible to when you make an application for home financing. In the event that very little else, it does offer you far more choice instance decreasing the matter from obligations you take into through a big downpayment.

How to reveal care about-employed money for a home loan?

Showing mind-employed money for home financing, you need to offer a track record of continuous notice-employment income for around 2 years. Very mortgage banks otherwise organizations can look for the following:

A career confirmation

A position confirmation allows you to illustrate that you is worry about-employed. One way to rating a position verification is to try to inform you letters otherwise emails from all of these supplies:

- current members

- authorized authoritative personal accountant

- elite groups which can be certain that your own registration

- Working Because the (DBA)

- insurance for your business

- any business otherwise condition licenses you keep

Income documents

You may be a stride closer to bringing acknowledged to own a beneficial financial when you yourself have income files. Most loan providers ask for these types of data:

- private tax statements

- profit and loss statements

- lender statements

Could it possibly be far better be reproduced otherwise thinking-useful for home financing?

Out of home financing lender’s position, it is more straightforward to determine debt updates whenever you are working rather than care about-employed. Here is a simple article on working individuals and worry about-operating individuals:

Employed mortgage

An employed debtor typically has a developed salary the help of its boss which is easily capable of producing a position verification and you can earnings records. Loan providers use this guidance to decide how much cash income the fresh debtor have to create to repay its financial.