Rating a loan pre-acceptance off a lender understand your restriction loan amount and you can inform you manufacturers you’re a significant client. Within the pre-approval techniques, a loan provider evaluates your financial situation and you will creditworthiness to choose your limitation amount borrowed and gives a great conditional connection for money.

3: Ready your mortgage files

Collect called for files, including proof earnings, bank account, financial comments, personality, tax statements, and you may credit profile in your nation off provider, to help with the loan app.

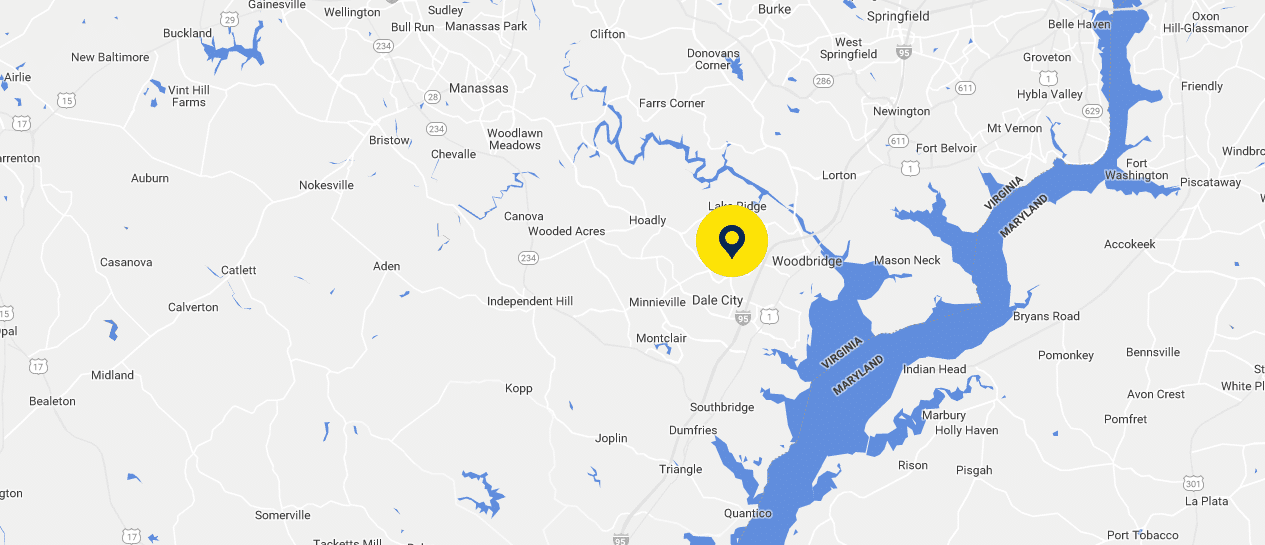

Look for appropriate investment features within your budget and also make an enthusiastic give with the one which most closely fits the requirements. United states states of numerous international dealers consider were Arizona, Colorado, Florida, Illinois, and you may North carolina.

Step 5: Setting a beneficial All of us organization eg an LLC

Introduce a beneficial You-oriented organization, for example a restricted responsibility company (LLC), to hold the fresh new money spent and supply liability security. To create a keen LLC, you must file Stuff of Parksdale loans Business towards compatible condition institution and afford the expected submitting costs.

Action six: Complete the loan application

Fill in the completed loan application and you will support data on lender for feedback, ensuring most of the required data is accurate or more-to-date to help you support a smooth and you may successful loan approval techniques.

Step eight: Lock the interest rate

Securing the interest rate function securing a specific interest rate towards the a loan to own a set period, normally 29 so you can two months. It covers the fresh borrower from prospective action for the markets prices throughout the loan acceptance techniques, guaranteeing it get the concurred-through to price at the closure, regardless of business standards.

Step 8: Mortgage control and you can underwriting

The financial institution will guarantee all of the criteria is actually met and you will be certain that your financial recommendations. Underwriting guidance are considering four fundamental items: Property value, debt-service-publicity proportion (DSCR), borrower’s liquidity, and you may borrowing profile at your home nation.

Step 9: Conduct property check and you will assessment

An expert inspector explores the fresh new property’s reputation during the property evaluation, determining possible items or required solutions. Into the an assessment, an authorized appraiser assesses the home to incorporate an independent imagine of the market value, improving the lender concur that the borrowed funds amount is appropriate to own the newest property’s value.

Step ten: Plan closure or take fingers

Complement towards the lender, term team, and you will merchant to make certain most of the required documents can be found in buy and you may financing are available for import. Opinion and you may indication all the last records on closure fulfilling, spend the money for needed settlement costs, and you may have the keys to your money spent, marking the conclusion of the mortgage process and the start of disregard the trip.

As to why Smart Buyers Use Capital for rental Assets

Wise buyers commonly have confidence in financing buying leasing attributes as an alternative out-of expending bucks for the entire purchase price. There are a few reason why financing are a nice-looking selection for people, also it often results in a top return on investment (ROI):

- Financing a rental property could possibly offer dealers a taxation-successful technique for promoting their cash disperse. By the subtracting loan interest costs off their pre-tax money, people can drop-off its tax accountability, that can free up currency that may be reinvested inside their assets or used in almost every other expenditures. So it improved earnings may help investors broaden their profile, boost their leasing assets, otherwise purchase even more local rental attributes to create a high get back with the investment.

- Using capital can help decrease risk. That with a mortgage system to borrow money in place of spending dollars, people decrease the risk coverage by continuing to keep additional money on the submit question of emergencies.

- Going for a sensible mortgage choice for resource may help investors magnify production. Leveraging other people’s currency unlike just relying on her money can allow buyers to acquire so much more services and you can probably feel greater prefer and cash move productivity. This leads to more important long-name money production and you will a very varied portfolio.